As accountants a question we often get asked is “Is this a good investment” or “What do you think of this investment idea”? As an accountant who is also very interested in all aspects of finance, investing and ASX shares more specifically, I don’t mind having a look at people’s portfolios. In fact, in order to complete a tax return, it is often an essential part of my job, and one I happen to really enjoy. Unfortunately for me (and countless more of my accounting brethren) accountants are not allowed to offer any kind of recommendation or financial advice. Regulations, as they currently stand, prohibit accountants from offering specific buy or sell recommendations. Anything beyond a simple “it looks good” can be considered too specific and construed as stepping on the toes of planners/advisers.

Generally, though the first thing I tend to notice when looking at full year portfolio reports from prestigious brokerage and financial advice firms, are the exorbitant annual “retainer fees” or “ongoing advice fees”. These fees are sometimes in the thousands of dollars and I can’t help but ask myself “what on earth are people getting for all of these fees”? Sure, the reports are nice and detailed, and the offices are probably very well equipped, no doubt inner city or CBD located, and they probably validate your parking when you go in for a meeting. However, none of that adds up to $5,000+ in annual fees. For that I personally would expect market beating performance, and insight leading to investment returns that make that $5,000 look like money well spent.

Don’t get me wrong I am not suggesting this advice be free, far from it. Initial portfolio construction, if correctly tailored to a client’s risk tolerance and expected investment returns, takes time and effort and you should have to pay for it. What I am talking about is charging people thousands of dollars to “manage” a portfolio consisting of one or more big bank shares, a Rio Tinto or BHP, and a Telstra thrown in for a bit of diversification. Not only is there not much in the way of “ongoing” advice, the portfolio I just described did not require any real insight or thought on behalf of the broker/adviser, you should not have to pay large sums of money for an adviser to collect dividends and interest on your behalf or sell shares at a loss at the slightest hint of market volatility. Too often the portfolios that I see are constructed of a few blue-chip shares, an Exchange Traded Fund (ETF – basically a managed parcel of shares that tracks an index) and cash, not much in the way of groundbreaking, market beating insight!

Another point to note is that, in the current ultra-low interest rate environment be wary of any adviser recommending a large percentage of your portfolio be held in cash. Whilst some cash kept in reserve is always good so that you can capitalise on opportunities (the current corona virus induced market selloff being a prime example of this) that arise in the market, at the moment even the best term deposit will only earn you 1.5% and the latest figures on inflation indicate that the rate of CPI (Consumer Price Index) is 1.8%. In simple terms this means that each dollar earnt is actually worth less in real purchasing power (1.5% < 1.8%) this is before tax as well! So be especially aware of advisers promoting a very high cash position and charging you handsomely in the process.

The reasons we here at Leddy’s & Associates feel so strongly about this are two-fold

The best portfolios in terms investment returns the we deal with here are from people who manage their own portfolio. I will grant you this takes discipline and time and isn’t for everyone. You need to research stocks and analyse reports, however there are various subscription services e.g.: Barefoot investor, Motley Fool Share advisor that you can avail yourself of for a small fraction of the cost to do this for you.

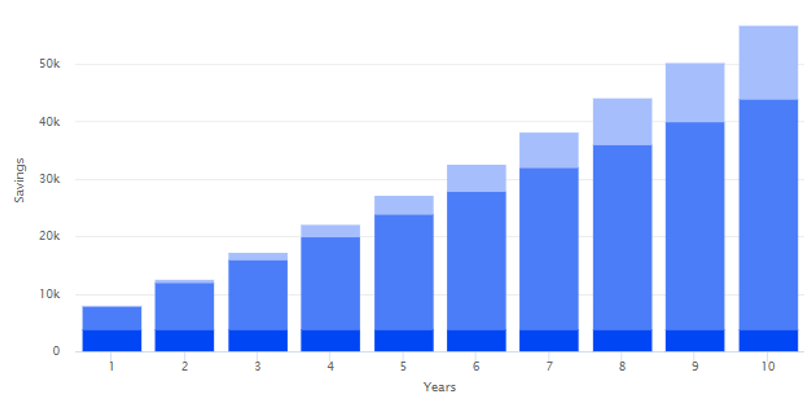

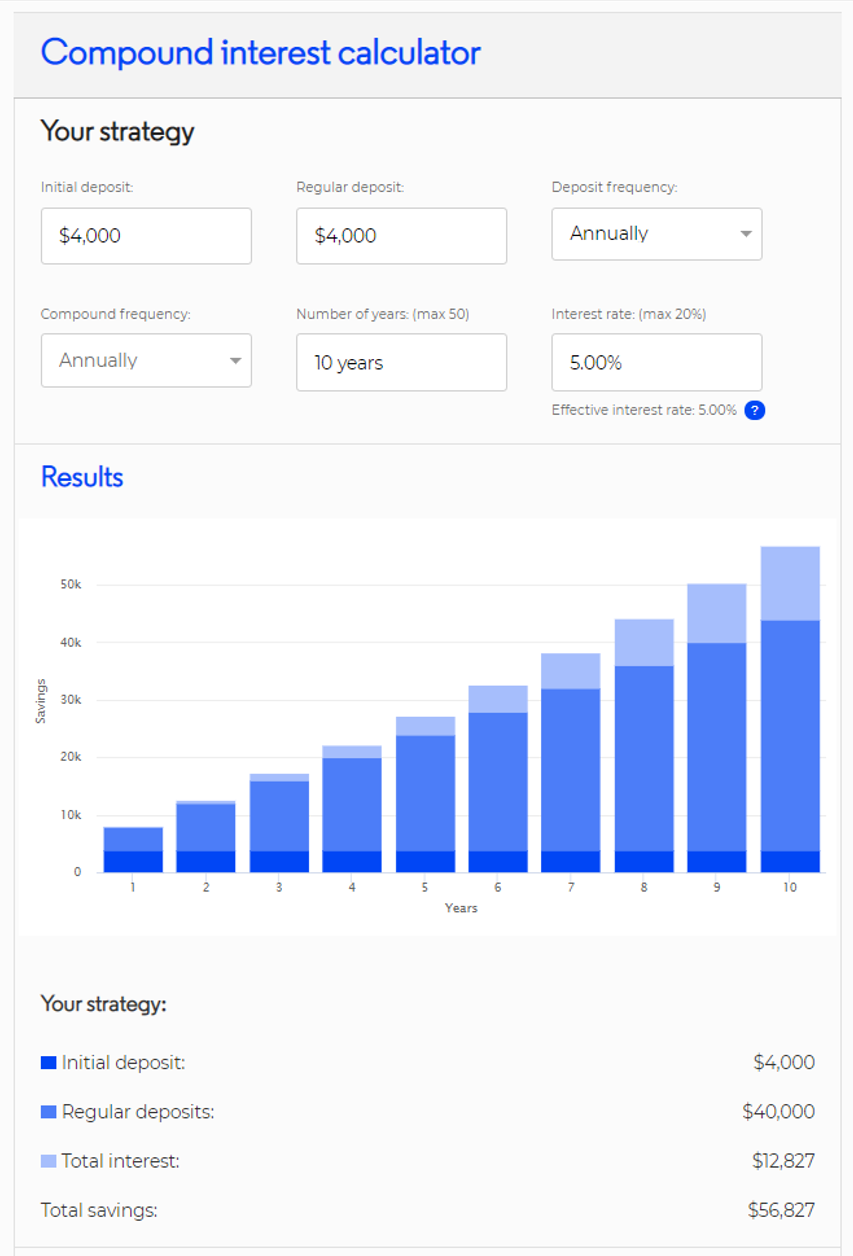

The long-term wealth destruction, on a compounding basis, of enormous fees is definitely worth considering. Did you know that $4,000 reinvested every year as opposed to paid in fees, at a rate of return of 5% (The ASX 200 index returns, on average, 10% over the last decade) will eventually become $56,000? Compounding is indeed a powerful tool.

In summary, the point of this article is not to tell you to leave your adviser rather it is to get you thinking about how much you may pay brokers/advisers and ask yourself this important question “can I get the same result for a fraction of the cost? It is important to note that not all advisers charge these crazy amounts of money and the vast majority of them earn their fees. After reading this article ask yourself if you are getting value for money on your “investment”.

Written by Glenn Barea